Foot Locker, Inc. shares have plummeted since its fourth quarter financial release on February 25 even though the sneaker retailer topped our estimates. The fall is part of a steady decline since last May, and Wall Street is increasingly worried about Nike’s shift to its own direct-to-consumer business.

Basics

Foot Locker boasts roughly 2,900 retail stores across nearly 30 countries under multiple brands. FL’s expanding portfolio includes its namesake, Champs Sports, Eastbay, WSS, Footaction, and more. The company has grown within the broader sneaker culture that’s developed alongside the rise of Nike, its Jordan Brand, and other popular and trendy shoemakers.

Recent Results

Foot Locker posted 15% comps growth in 2021, with revenue up 19% to $9 billion to help it blow away its pre-pandemic total of $8 billion. Meanwhile, its adjusted earnings skyrocketed 177% against an easy to compete against period.

FL benefitted from the economic comeback and strong consumer spending. Foot Locker also raised its dividend by 33% and is set to roll out a new $1.2 billion buyback program. All of this should have wowed investors. But Wall Street focused on the company’s rather substantial change to its vendor mix going forward.

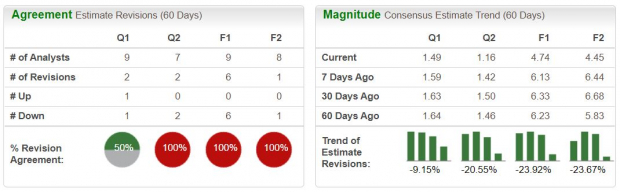

Image Source: Zacks Investment Research

Nike Troubles

Foot Locker said that starting in the fourth quarter of 2022, it does not expect any single vendor will represent more than 55% of total supplier spend, which would be down from 65% in the Q4 FY21. Consequently, FL executives expect no single vendor (Nike) to represent more than roughly 60% of total purchases in FY22, down from 70% last year and 75% in 2020.

The company said the move “reflects the accelerated strategic shift to DTC by one of the Company's vendors and Foot Locker, Inc.'s ongoing brand and category diversification efforts.” Many on Wall Street have been worried for years about Foot Locker’s heavy reliance on Nike.

Nike is the most powerful and popular sneaker company in the U.S., even amid a resurgent Adidas. This has helped Foot Locker for years, and NKE has continued to work with FL even as it cuts ties with many other retailers in favor of its own stores and e-commerce business.

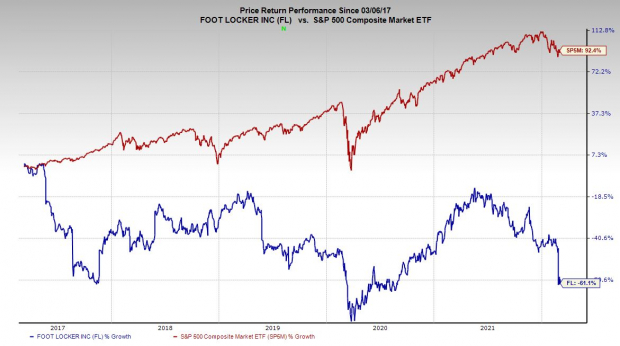

Image Source: Zacks Investment Research

Bottom Line

Foot Locker’s FY22 and FY23 consensus earnings estimates have both tumbled over 20% since its Q4 release to help it land a Zacks Rank #5 (Strong Sell) at the moment. FL shares have dropped around 30% since its report and 43% in the past year.

The recent decline is part of a long-term trend over the past five years, with Foot Locker shares down 60% vs. its industry’s 30% decline. Foot Locker could no doubt bounce back after its huge drop. Still, long-term investors might want to stay away from FL stock until it proves it’s ready to thrive in its next, less Nike-heavy era.

Bear of the Day: Foot Locker, Inc. (FL)

Foot Locker, Inc. shares have plummeted since its fourth quarter financial release on February 25 even though the sneaker retailer topped our estimates. The fall is part of a steady decline since last May, and Wall Street is increasingly worried about Nike’s shift to its own direct-to-consumer business.

Basics

Foot Locker boasts roughly 2,900 retail stores across nearly 30 countries under multiple brands. FL’s expanding portfolio includes its namesake, Champs Sports, Eastbay, WSS, Footaction, and more. The company has grown within the broader sneaker culture that’s developed alongside the rise of Nike, its Jordan Brand, and other popular and trendy shoemakers.

Recent Results

Foot Locker posted 15% comps growth in 2021, with revenue up 19% to $9 billion to help it blow away its pre-pandemic total of $8 billion. Meanwhile, its adjusted earnings skyrocketed 177% against an easy to compete against period.

FL benefitted from the economic comeback and strong consumer spending. Foot Locker also raised its dividend by 33% and is set to roll out a new $1.2 billion buyback program. All of this should have wowed investors. But Wall Street focused on the company’s rather substantial change to its vendor mix going forward.

Image Source: Zacks Investment Research

Nike Troubles

Foot Locker said that starting in the fourth quarter of 2022, it does not expect any single vendor will represent more than 55% of total supplier spend, which would be down from 65% in the Q4 FY21. Consequently, FL executives expect no single vendor (Nike) to represent more than roughly 60% of total purchases in FY22, down from 70% last year and 75% in 2020.

The company said the move “reflects the accelerated strategic shift to DTC by one of the Company's vendors and Foot Locker, Inc.'s ongoing brand and category diversification efforts.” Many on Wall Street have been worried for years about Foot Locker’s heavy reliance on Nike.

Nike is the most powerful and popular sneaker company in the U.S., even amid a resurgent Adidas. This has helped Foot Locker for years, and NKE has continued to work with FL even as it cuts ties with many other retailers in favor of its own stores and e-commerce business.

Image Source: Zacks Investment Research

Bottom Line

Foot Locker’s FY22 and FY23 consensus earnings estimates have both tumbled over 20% since its Q4 release to help it land a Zacks Rank #5 (Strong Sell) at the moment. FL shares have dropped around 30% since its report and 43% in the past year.

The recent decline is part of a long-term trend over the past five years, with Foot Locker shares down 60% vs. its industry’s 30% decline. Foot Locker could no doubt bounce back after its huge drop. Still, long-term investors might want to stay away from FL stock until it proves it’s ready to thrive in its next, less Nike-heavy era.